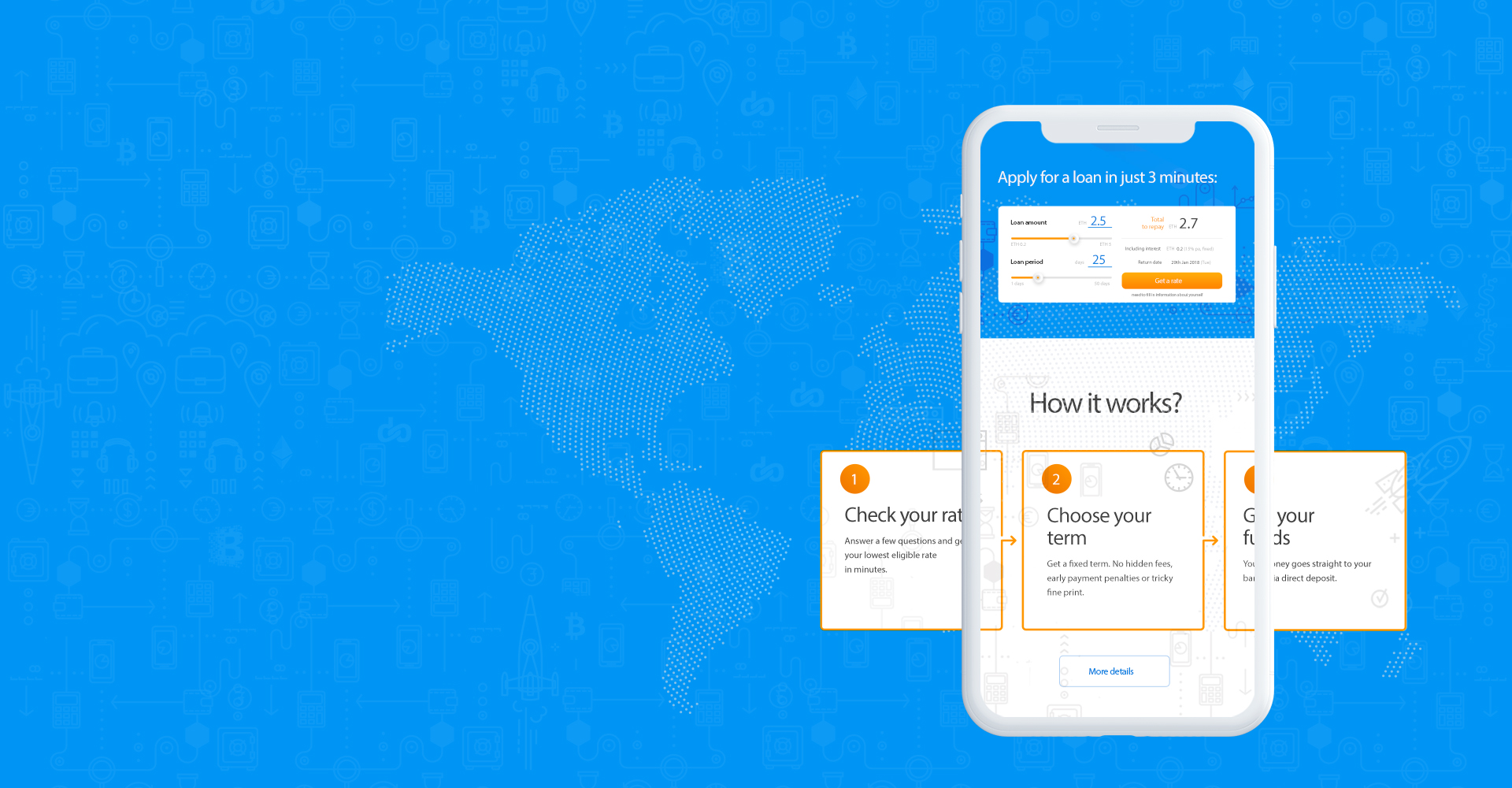

Lendoit is a decentralized P2P lending platform, connecting borrowers and lenders from all over the world in a trusted, fast and easy way, using the advantages of smart contracts and blockchain technologies.

What makes us unique?

The Only Platform That is 100% Decentralized

Without Use of Tokens as Collateral

Interest is Set By A Smart Contract Auction

Using Smart Compensation Fund

Using Syndicated Loans

Using 3rd Party Scoring/Verification Local Companies

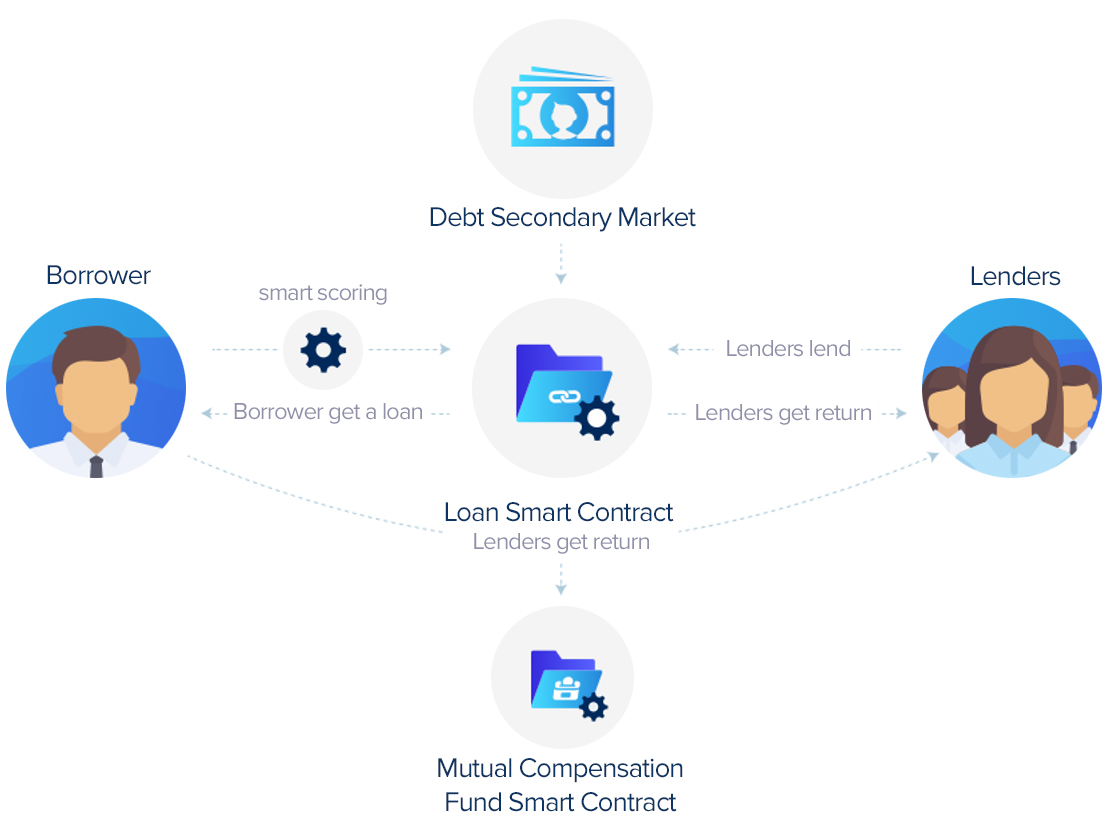

Using the Smart Loan Contract, both borrowers and lenders can eliminate the need of any 3rd party in order to deal with each-other. They can simply interact through their wallets using the platform as the monitoring intermediary.

By using a system of Smart Contracts along with a combination of elements from the traditional lending world, Lendoit users can benefit from a seamless trusted and secure lending process.

As result the lenders can remain completely anonymous and does not need to register anywhere, all they need to do is simply select their preferred loan from the marketplace and initiate it straight from their wallets.